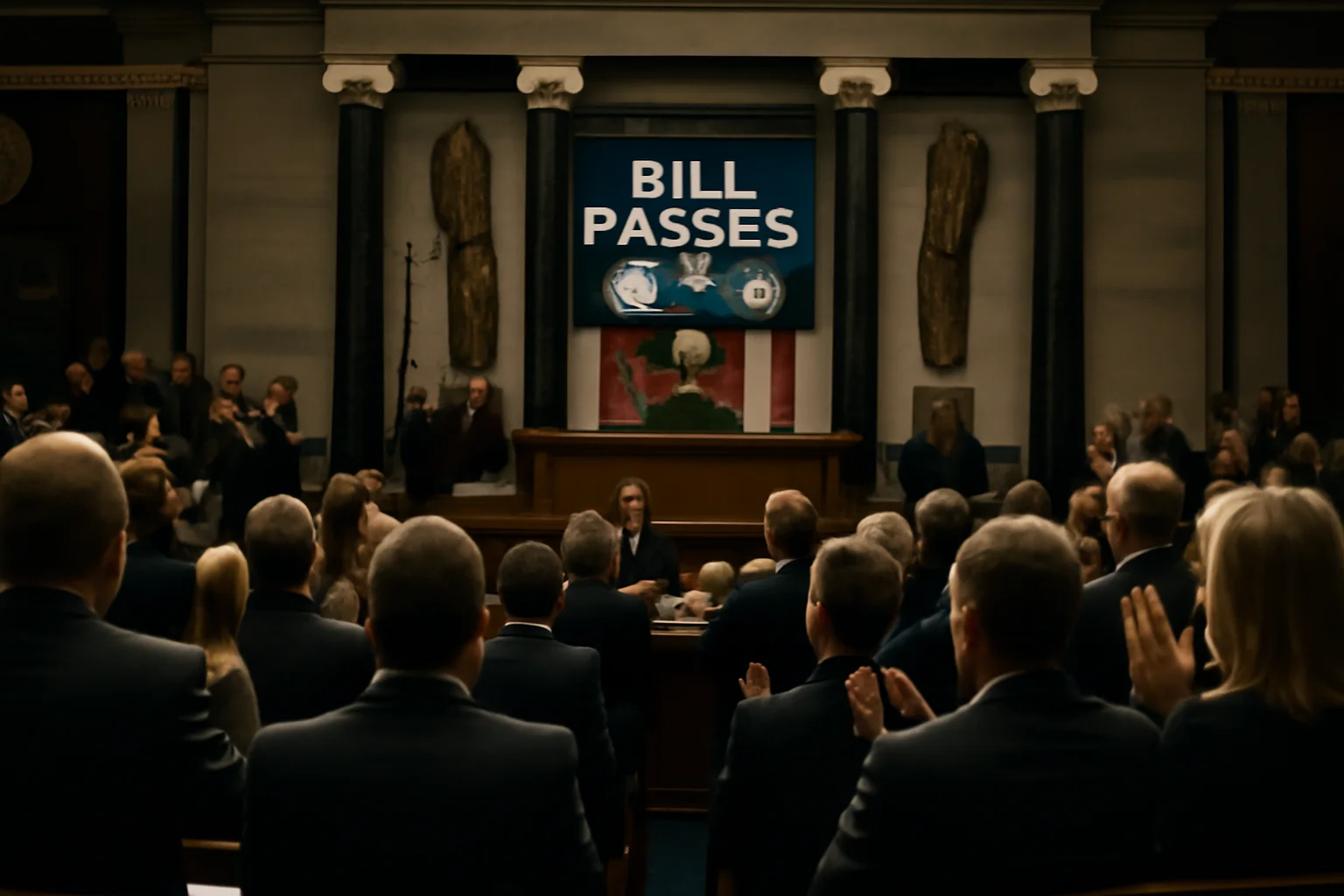

With new rules in place, the race was on for banks, tech firms, and startups to carve out their share of the stablecoin market.

Amazon, Walmart, and other corporate giants eyed digital tokens as the future of customer loyalty and payments, reshaping how Americans spend and save.

Traditional banks sought to bridge the gap, exploring partnerships and new services built atop blockchain rails.

Crypto exchanges and DeFi projects, emboldened by the promise of regulatory clarity, moved quickly to expand their reach and offerings.

For everyday Americans, the changes brought both opportunities—like lower fees and faster payments—and new risks, as digital wallets and stablecoins became part of daily life.

Lawmakers promised continued oversight, with new subcommittees and watchdogs tasked with keeping an eye on the rapidly evolving sector.

Meanwhile, the international community watched closely, as U.S. policy decisions sent ripples through global markets.

Some analysts predicted a boom in financial inclusion, while others saw the risk of new forms of inequality and exclusion.

Through it all, the crypto industry celebrated its hard-won legitimacy—even as it braced for fresh scrutiny.

The lines between Wall Street, Silicon Valley, and Main Street had never been blurrier.